Creative selling - Gap Plans are Back

- Howard E. Deihl, RHU

- Jan 15, 2018

- 1 min read

Bringing more creative options to the table can distinguish you from your competition.

First let’s identify the needs of both the employer and the employee.

Employers still want and / or need to offer employee benefits to attract and retain quality employees.

However, many employers have resulted to purchasing high deductible plans with high out-of-pocket cost to make it affordable to the business.

The employees on these plans may feel like their benefits are out of reach due to the high out-of-pocket cost, therefore diminishing the perceived value of their benefits.

In the past some employers have purchased Gap Plan, Flexible Spending Accounts (FSA’s), Health Reimbursement Accounts (HRA’s), and High Deductible Health Plans (HDHP’s) which are HSA qualified to reduce premium cost. Each has been a valuable tool to ease the burden of high healthcare cost.

Gap plans are back with new designs, and are more affordable. We offer 3 companies to choose from to insure you find right plan for your client.

Out new gap plans offer a low cost alternative to employees and protect them from higher out-of-pocket cost.

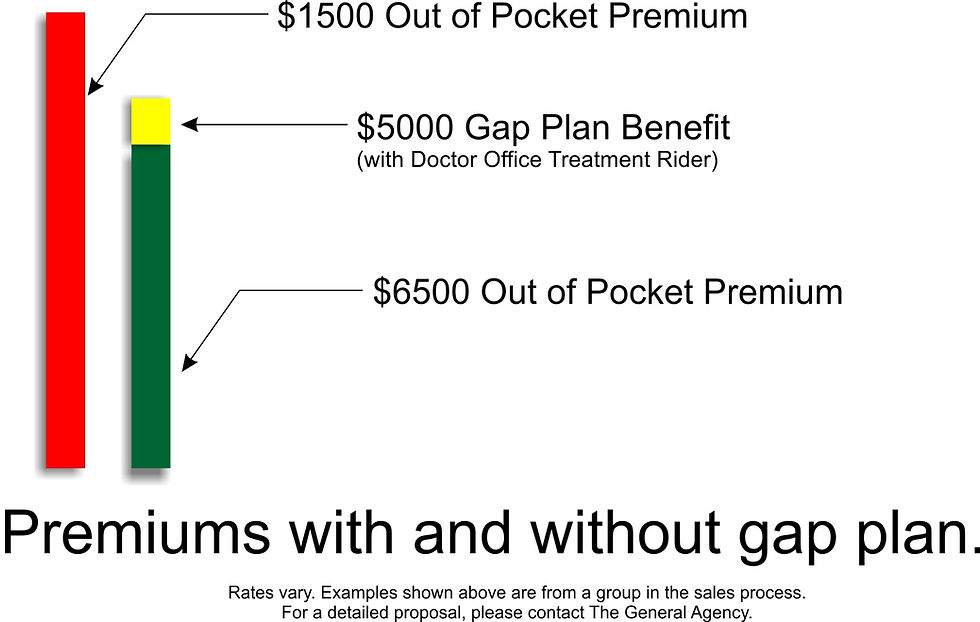

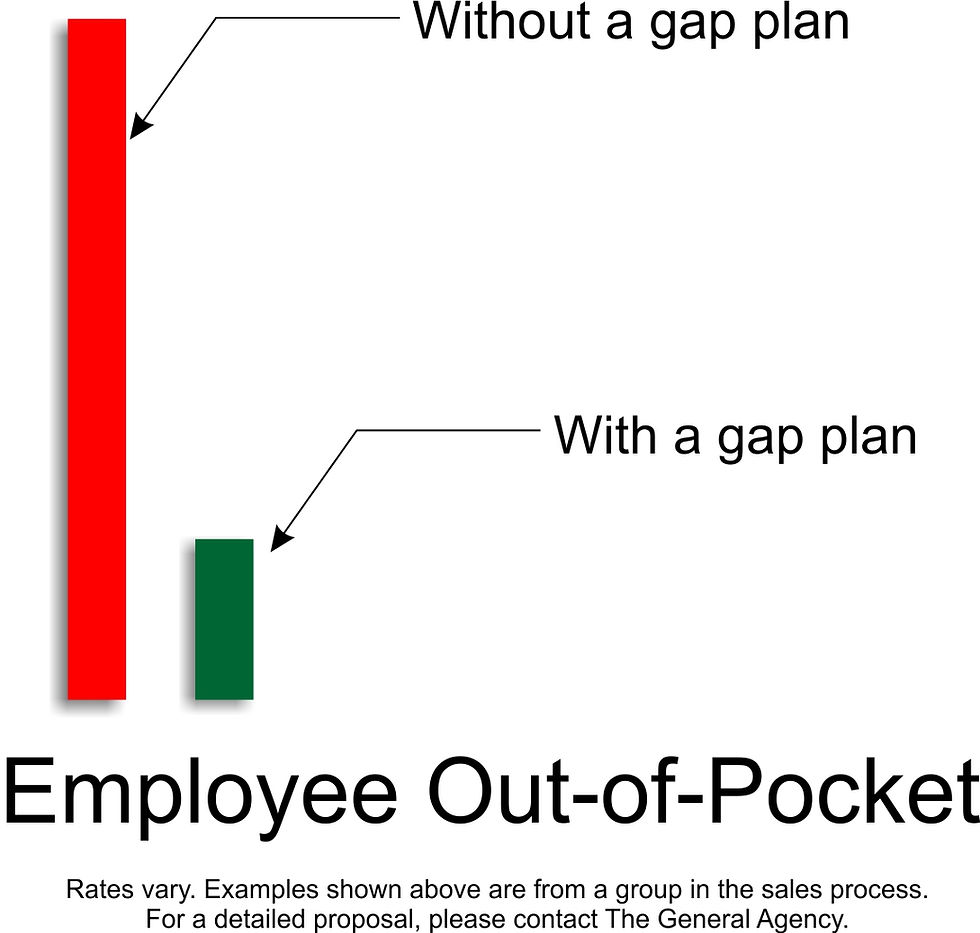

In the graphs above, we offered a high deductible health plan with a gap plan and saved the employer 24.1%, while reducing the employees out-of-pocket exposure from $6500.00 to $1500.00.

Contact us today for more information.

Comments